One option is accepting an FHA loan and the MIP that it comes with, then refinancing into a non-FHA loan once you’ve built enough equity in your home. However, there are other options as well. It means opting for a conventional loan with a 20 percent down payment. The borrower will use a different lending program to cancel FHA mortgage insurance.

All FHA loans involve mortgage insurance, either for the life of the loan or for a set number of years.

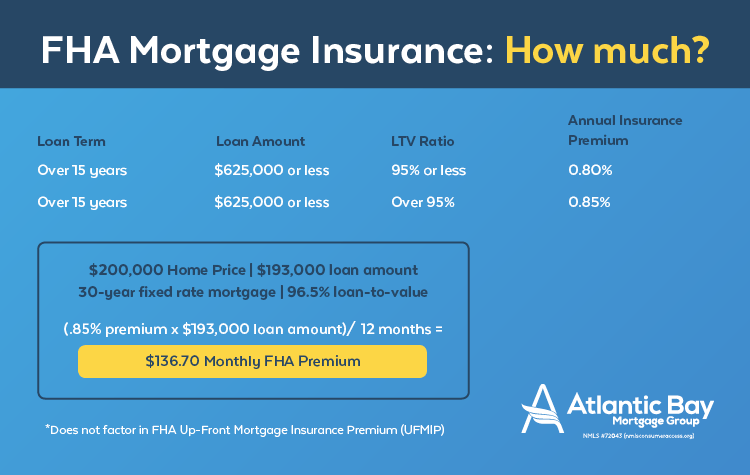

Qualifying for an MIP refund is half the battle. But because you’re eligible for a refund of around $3,045, your new upfront MIP cost will be about $4,830. The upfront MIP for your new loan will be $7,875. Let’s say you’ve paid off $50,000 from your original loan and you’re now borrowing $450,000. Because you’ve had the loan for 12 months, you qualify for a 58% refund, which is about $3,045. The first step is to consult HUD’s refund chart to learn how much your refund will be. Since you meet the criteria – you closed on the loan less than 3 years ago, and you’re refinancing to another FHA loan – you will likely receive a refund. Because interest rates are lower or you want to change your loan term, you decide to refinance to an FHA Streamline Refinance loan. Your upfront MIP fee was 1.75% of your loan amount, or $5,250. Suppose you took out a $300,000 FHA loan a year ago. Your MIP refund is calculated by multiplying your existing loan’s upfront MIP by the refund percentage indicated on the FHA MIP refund chart. How Is an FHA Mortgage Insurance Refund Calculated? The sooner you refinance, the more money you’ll get back. These premiums are the driving force behind the FHA’s ability to offer low-interest rates.įHA borrowers can get a refund on their upfront MIP if they refinance within three years of loan origination. The UFMIP is either paid at closing or folded into your home loan.īorrowers are charged annual and upfront MIPs to help keep the cost of FHA mortgage loans low. And you also pay an upfront MIP that equals 1.75% of your loan amount. You pay an annual MIP that gets added to your monthly mortgage payments. When you take out an FHA loan, you pay two types of MIP. And if you want to take advantage of it, we’ve put together a comprehensive FHA MIP refund chart guide. But it’s certainly the unsung hero of FHA loan benefits. The FHA publishes a chart outlining how much you may be eligible to receive as a refund. If you refinance your existing FHA loan to another FHA loan, you may qualify for a refund on the upfront mortgage insurance premium (UFMIP) you paid when you took out your original FHA loan. They offer low-interest rates, relaxed credit requirements, and low down payments.Īnd there’s another unique benefit. Loans originated by the Federal Housing Administration (FHA) are a great option for home buyers, especially first-time home buyers.

0 kommentar(er)

0 kommentar(er)